Trend-Following Strategy Pack

Next-generation Python code for systematic momentum and trend-following tradingOverview

This pack includes 21 research-driven momentum and trend strategies for modern systematic traders. Each strategy is delivered with Python code, backtest templates, and a comprehensive PDF manual—ready to run or adapt to your workflow.

What’s Inside: Advanced Momentum & Trend Engines

- ATR-Scaled Trailing-Stop Momentum: Uses an ATR-based adaptive trailing stop for volatility-aware trend capture.

- Composite Price-Volume Momentum Index: Fuses price and volume momentum into a unified, adaptive signal.

- Cross-Sectional Risk-Parity Momentum: Allocates by cross-sectional momentum, weights by volatility for risk parity.

- Donchian Channel Breakout with Dynamic Bands: Channel widths adapt to volatility for robust trend breakouts.

- Dual Momentum (Absolute + Relative): Classic momentum blend—time series and cross-sectional combined.

- Ehlers SSM Strategy: Uses Ehlers' Super Smoother for low-lag, noise-resistant trend detection.

- Extreme-Value-Theory (EVT)–Adjusted Momentum: Dynamically adapts momentum thresholds using EVT.

- Fractal-Adaptive Moving-Average Momentum: Moving average adapts to local fractal dimension of price.

- Fuzzy-Logic Trend Fusion: Fuzzy logic blends multiple signals for smarter, regime-aware entries/exits.

- Genetic-Algorithm Threshold Optimization: Evolves/optimizes momentum parameters with a GA.

- Kalman-Filter Trend Estimation: State-space Kalman filter for smooth, adaptive trend estimation.

- Keltner Channel Breakout with Dynamic Bands: Trades Keltner channel breakouts with volatility-adjusted bands.

- Machine-Learning-Augmented Momentum: ML layers filter and enhance classic momentum signals.

- ML-Probability Threshold Momentum: Trades only when ML models output high-confidence signals.

- Principal-Component Momentum: Uses PCA on returns to extract the strongest momentum factor.

- Regime-Adaptive Momentum with HMM: Switches logic based on market regime, detected with HMMs.

- Relative-Volume Spike Momentum: Only trades momentum on statistically significant volume spikes.

- Renko-Brick Breakout Momentum: Follows breakouts using Renko chart structure to reduce noise.

- Skewness- and Kurtosis-Adjusted Momentum: Momentum logic adjusts for current skew/kurtosis.

- Volatility-Scaled Time-Series Momentum: Classic TSMOM, with volatility-adaptive sizing and entries.

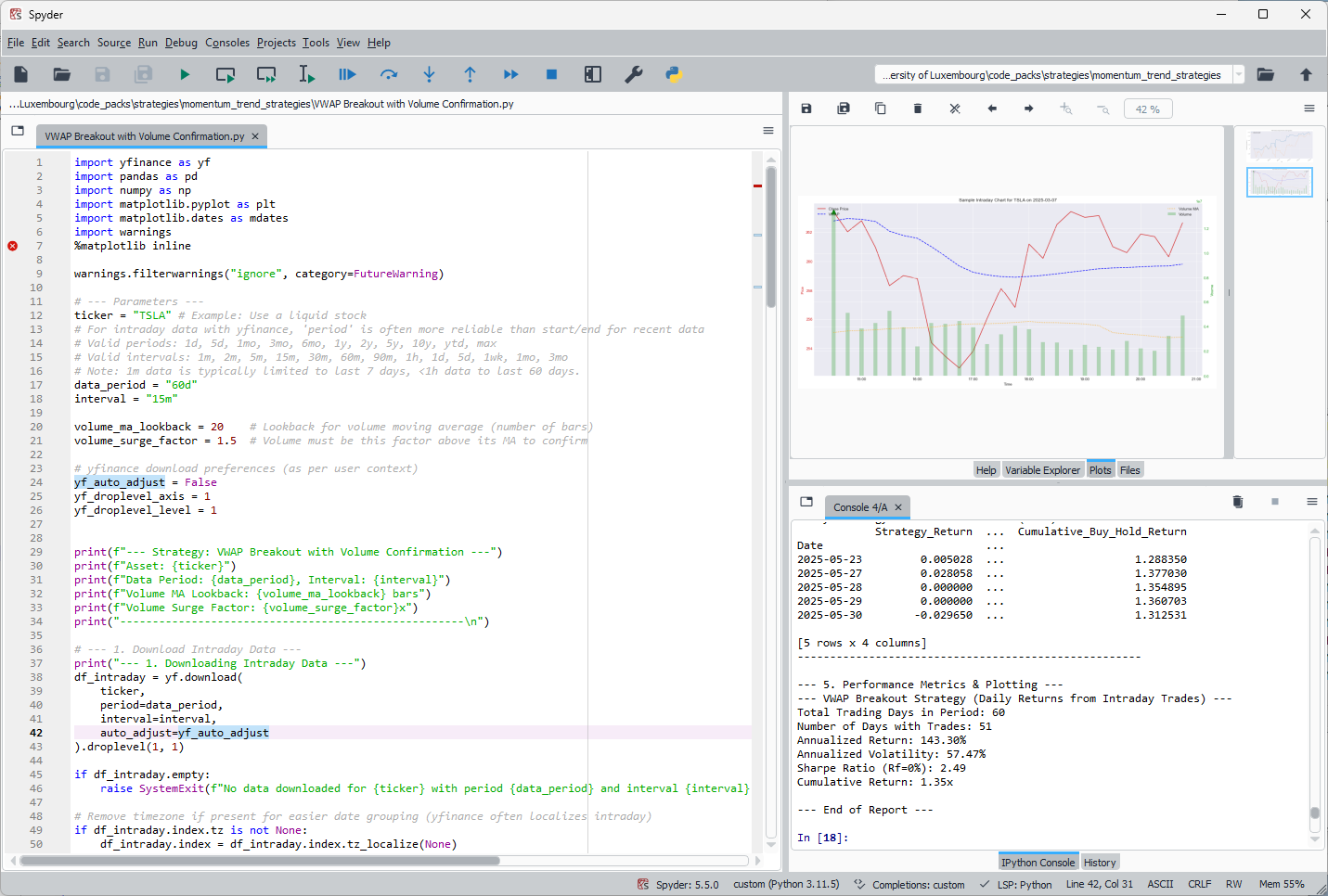

- VWAP Breakout with Volume Confirmation: Trades VWAP breakouts, requires volume confirmation for entries.

What You Get

- Full Python source (

.pyformat) - Sample backtests and example configs for each strategy

- PDF manual and docs for all strategies

How It Works

Import any strategy, plug in your data, set your parameters, and backtest or trade live. Fully compatible with Backtrader and Python quant frameworks.

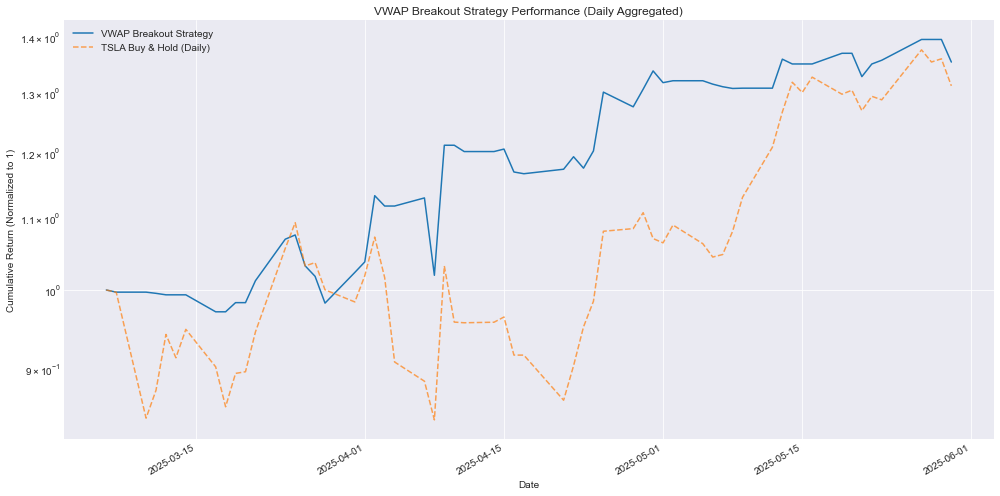

Performance Snapshots

Sample results for VWAP Breakout with Volume Confirmation (actual performance will depend on market, timeframe, and parameters):

- --- VWAP Breakout Strategy (Daily Returns from Intraday Trades) ---

- Total Trading Days in Period: 60

- Number of Days with Trades: 51

- Annualized Return: 143.30%

- Annualized Volatility: 57.47%

- Sharpe Ratio (Rf=0%): 2.49

- Cumulative Return: 1.35x

Documentation & Support

- PDF manual for all 21 strategies (download)

- Ongoing code updates and direct support

Get the Momentum & Trend Strategy Pack Now

Download instantly and unleash a full momentum/trend arsenal for modern markets. Lifetime updates and support included.

Purchase Now!